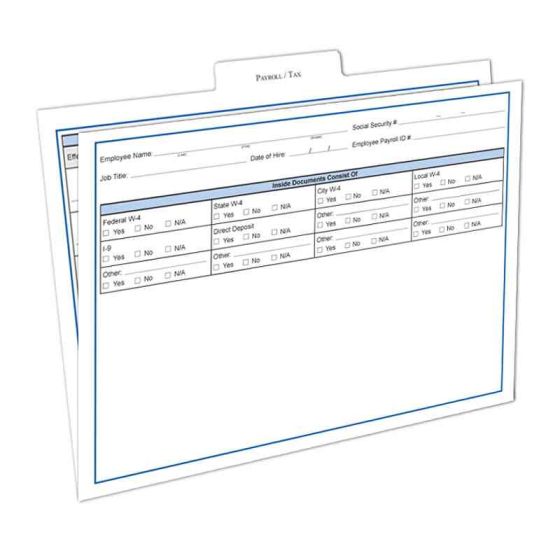

Payroll/Tax Folder

FED3010

Employers with full-time employees or employees that have worked for a certain period of time will be required to pay payroll tax for those employees. Each state has different requirements in terms of what types of employees employers need to pay payroll taxes for and how long those employees need to have been employed in order for the employer to have to pay payroll taxes.

Product Specifications

- 25 Payroll/Tax Folders

- Size 9.5 x 11.75

- Inside of folder contains Earnings History and Withholdings

- Fields for employee name, social security, job title, etc.

- Section listing inner contents of folder

FED3010

Why the Payroll/Tax folder is important

In order for employers to stay organized and efficient, employers need to have easy access to information that can help them pay their payroll taxes accurately. This information and a record of payroll tax histories for employees can be stored in this durable payroll tax folder. Using this folder, employers can quickly obtain information about current and past employees that will help them to meet all payroll tax requirements.

Employers are required to retain information pertaining to an employee’s finances for at least seven years – even for those employees who are no longer employed by a company. This information may need to be accessed in the event that the employer or the employee is audited. Therefore, having quick and easy access to important payroll tax information may be important for years to come.

The durable payroll tax folder helps to ensure that employers will always be organized and able to find information about payroll taxes for all employees, even when employees are no longer with a company. Tabbed dividers also help employers to customize their organization systems for their unique needs and requirements.