The Federal Contractors minimum wage is set to undergo an inflation adjustment on January 1, 2018, raising the new Federal Contractor Minimum wage to $10.35 per hour.

Covered tipped employees must be paid at least $7.25. If a worker’s tips, combined with the required cash wage of at least $7.25, does not meet the minimum wage for the contractor, the contractor must increase the wage to make up the difference.

Contractors who do not comply with the law will be subject to potential penalties, including suspension / debarment from federal work, financial penalties, and possibly criminal penalties.

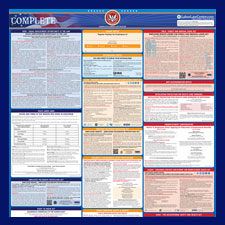

The Federal Contractor minimum wage carries a mandatory posting requirement. At The Labor Law Center we continually monitor local, state and federal posting requirements and will make them available as soon as we receive them. The 2018 Federal Contractors Edition Poster is currently available for order.

The Labor Law Center also offers a worry-free service to our customers through our Poster Service Plan with automatic replacements. What this means is that we monitor the state and federal postings and automatically send you updates when they are released. It is that simple!

We also offer clients our popular Education Center. If you are new to labor law compliance or just wanting to keep up with the latest news and changes as they come out, this is the place to bookmark and visit regularly.